As we’ve seen in our previous posts, timing the market is an almost impossible feat to perform. We’ve demonstrated that the risks involved in market timing can be large in terms of failing to meet your financial goals.

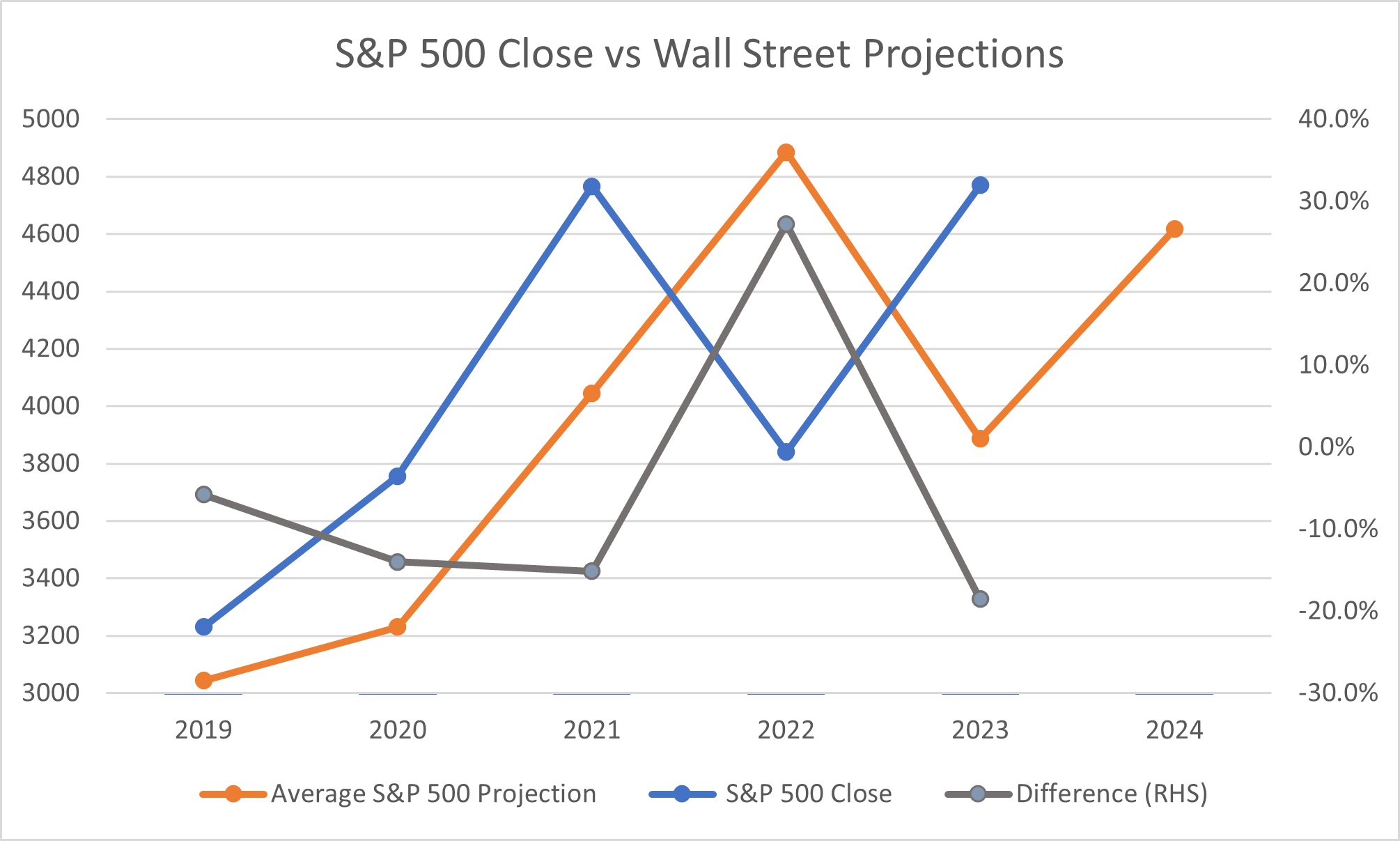

If you want to start investing today, you might think it is worthwhile to look at what Wall Street (the supposed pros) are thinking of for 2024, and their track record:

(Source: Bloomberg, projections taken from 12 banks)

Not only have the brightest minds in Wall Street missed the mark by at least 5% each year, but the projections seem to be worsening over time!

Now for one who is about to start investing, you might be thinking – if the supposed best minds can’t predict it consistently, you might be better off by staying invested. And to do that, you need to deploy your capital. How then can you invest in a ‘timing-neutral’ manner? Here we evaluate two methods of deployment:

- Lump Sum Investing (LSI)

Investing all your available money at once – if you have $1,000 to invest into S&P 500 at the start of 2023, you will buy $1,000 of S&P 500 on Jan 1. This means you are fully deployed on day 1.

- Dollar Cost Averaging (DCA)

Investing your money over time – Instead of going “all in”, for each month, you will buy $100 of S&P 500 on a set date each month. For an investment budget of $1,000, this means you will be fully invested by Oct 2023.

Case study: LSI or DCA?

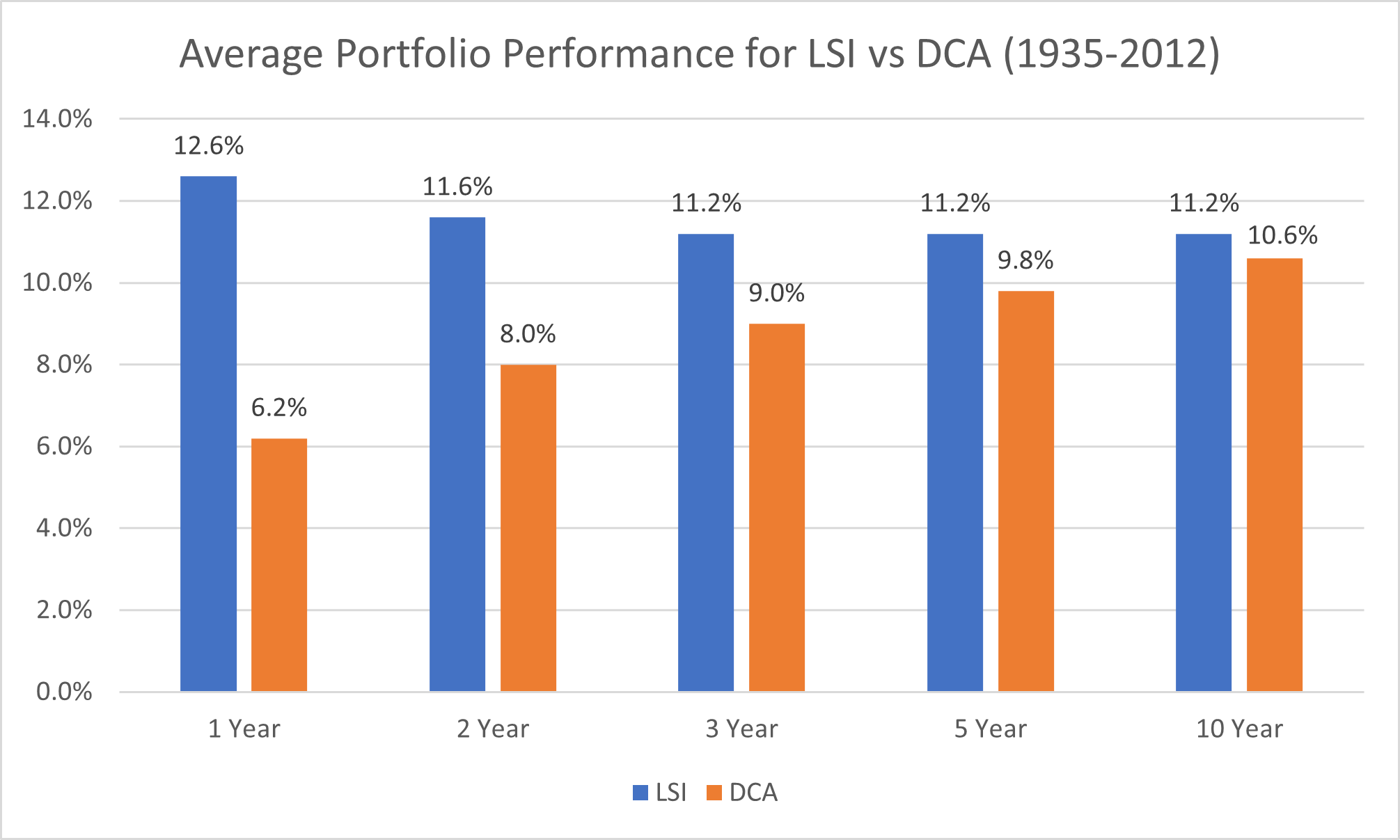

Let’s reference a study done by Partner’s Capital, who simulated returns for an S&P 500 portfolio invested according to LSI or DCA for every month from January 1935 to January 2012.

For LSI, the portfolio is fully invested on day 1.

For DCA, the portfolio is deployed across two years at quarterly intervals with equal quantum. Uninvested balances were held in cash. This presents 936 monthly “entry points”, a rich array of data:

(Source: Partner’s Capital – Portfolio Deployment)

The results show that the LSI approach does produce a higher average return across all time periods. However, it does come with risks:

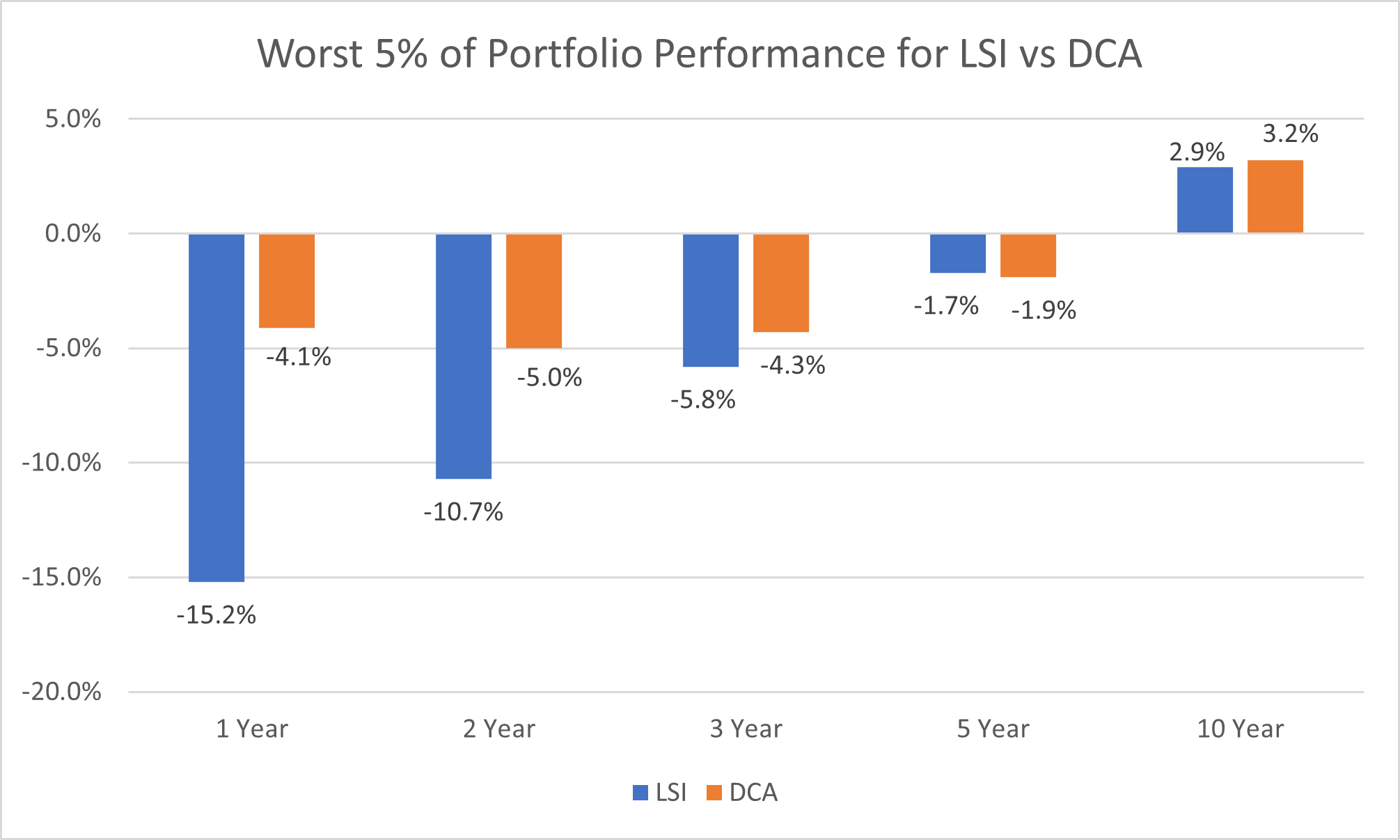

Within 1 – 3 year time periods, the worst 5% of outcomes for the LSI portfolio are more severe than DCA portfolios. From 5 years onwards, the disparity in outcomes reduces. The results are intuitive: over any time period, a fully invested portfolio of equities outperforms a partially invested portfolio of equities and cash (stay invested!). The only periods when DCA outperformed LSI were when there were significant market drawdowns.

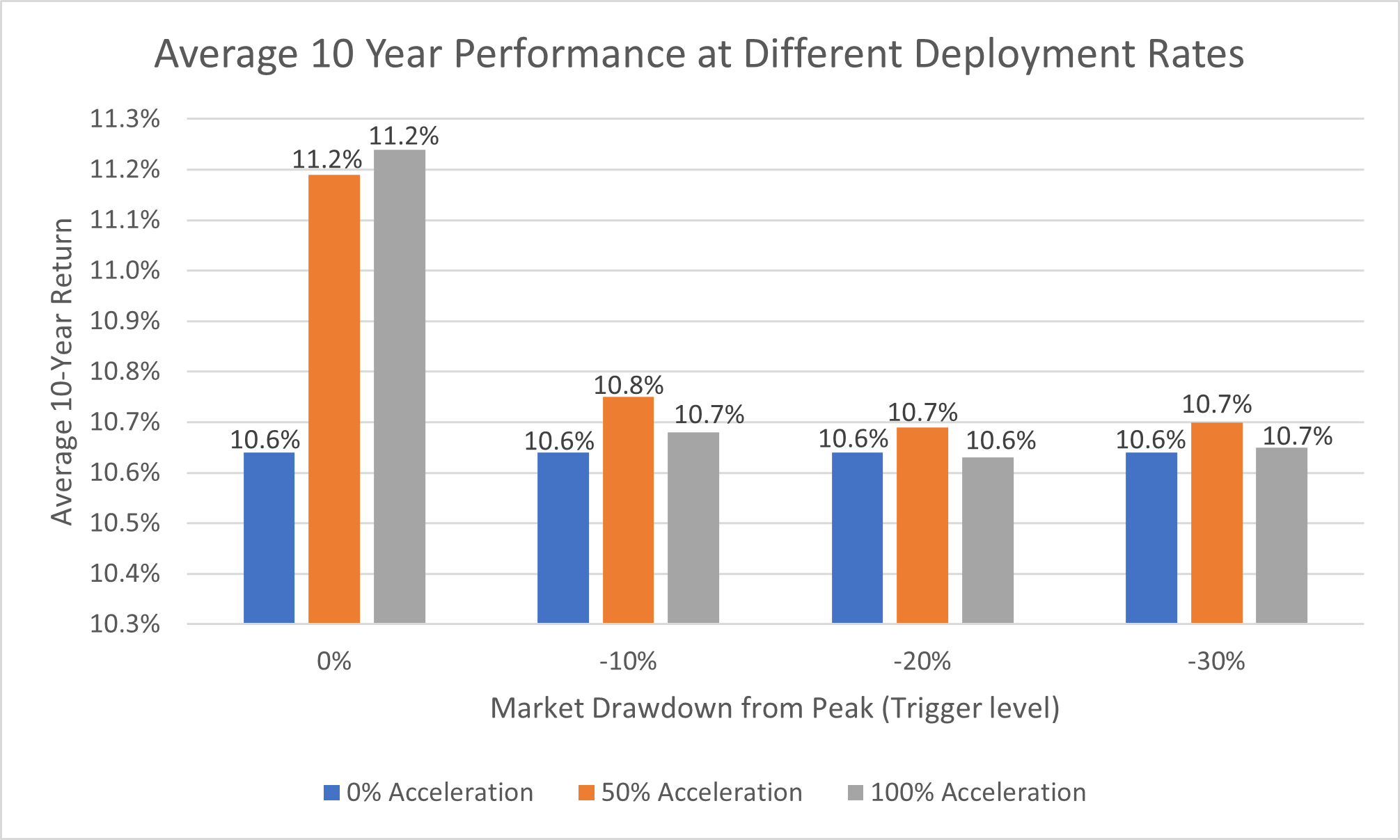

Wait, you might be thinking – during drawdowns, there might be some element of market timing that allows one to consistently produce better returns via DCA. By accelerating the deployment plan at different trigger points (drawdown levels), one can achieve better ten-year average returns. For example, if you have 10 months left to fully deploy and the market draws down by 10% from its peak, and you can accelerate deployment by 100% (deploying the rest within 5 months). Testing it across different triggers and acceleration rates, this hybrid method does produce better results:

The baseline 10.6% return (no acceleration) is outperformed by accelerating the deployment rate across almost all market drawdown events.

What works for you?

The decision to use LSI or DCA depends on your risk appetite and loss aversion. Individuals who sleep well in times of volatility can consider the LSI approach, whereas investors who are more sensitive to drawdowns should consider the DCA approach. During drawdown periods, they can even pick up the pace of deployment to get more bang for their buck. And there you have it – a way to ‘time’ the market.