By Peter Williamson, Senior Adviser, Javelin Wealth Management

Compound Interest – The 8th Wonder of the World

For investors, the guy above needs no introduction. Warren Buffett is someone we all strive to become when it comes to investing. He is currently the 6th richest man in the world, with a net worth of US$135 billion.

E=mc2, photoelectric effect, the quantum theory of light… Remember all the pains that we had undergone in physics class during our school days? All thanks to this guy – Albert Einstein.

What do these two men have in common apart from being seen as a geniuses in their respective fields? The answer is “compound interest”:

“My wealth has come from a combination of living in America, some lucky genes, and compound interest” – Warren Buffett

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it” – Albert Einstein

So…

What is Compounding?

In simple terms, compounding is when you earn interest on interest. The longer you do, the more your money grows, and the more money you have on which you earn more interest. In the long run, your money will grow exponentially through the magic of compounding.

To illustrate:

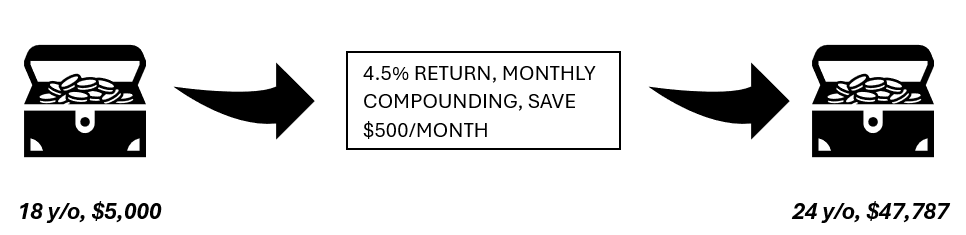

Adam is 18 years old and has just completed junior college. He is going to serve 2 years of National Service followed by 4 years of university. During this period, he could save $500 a month from his NS pay and allowance from parents. He also has starting savings of $5,000.

Since he has no knowledge of investment, he decides to keep things simple and to invest in the US 2-year treasury bill, which generates a tax-free return of 4.5% per year.

When he turns 24 years old in 6 years, regular savings and the power of compounding would turn us wealth from that initial $5,000 to $47,787. Not bad for a fresh graduate.

It gets better…

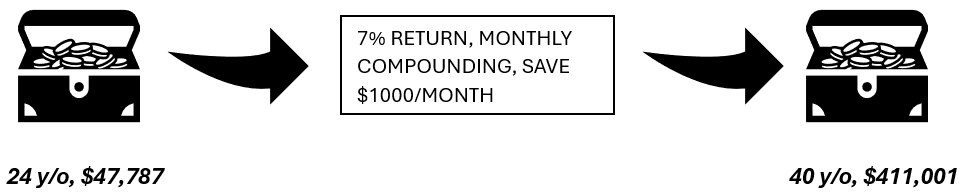

Upon graduation, Adam becomes an investment guru and earns a monthly salary from his new job. He can now save $1,000 a month and is able to generate a higher return of 7% a year.

14 years later, at the time he turns 40, his wealth would have grown from that $47,787 to a whopping $411,001.

Key Takeaways

- Start saving early. The earlier you start saving, the longer you can experience the magic of compounding. You will see exponential growth as time passes by. So, the earlier you start saving, the greater will be the gain.

- Contribute to the principal regularly and do not take out the interest earned. Keep this as a separate saving account which you will not use for daily expenditure.

- Minimise your debt. While compound interest could work in your favor, it could work also against you. Items such as student loans, credit card bills and other forms of debt use compounding as well. So – if you just pay the monthly minimum on your credit card, you will be confronted by a steadily increasing underlying debt. Instead of receiving interest on interest, you end up paying interest on interest (it’s instructive that many governments around the world seem to have forgotten that lesson). The faster you pay it down, the less you owe.

The Bottom Line

Compounding is a great tool to supercharge your wealth. You could reach your financial goal with a smaller amount of money if you make use of it. Beware of the flipside if you are in debt. But if you are in doubt, have a chat with a financial adviser.