Dec 21, 2023 in Investments, Wealth Management

Goal-Based Investing — Is time on your side?

It’s all about ‘Time in the market, not timing the market” right? Yes, especially in longer time frames, typically touted as five years or more…

But what about when that time frame is short, say 12 to 18 months or less? Does timing matter? We suggest that “it depends”. Time may not be your friend in the short term. The need to meet a defined financial goal tomorrow can be thought of as a financial liability today. As the time to achieve the goals draws nearer, investors need the certainty that they have what it takes to meet it – whether they have the necessary funds from savings and investments.

In the event of a discrepancy when the obligation must be fulfilled, and the asset you intend to sell to cover it is not readily accessible, you may find yourself amid a liquidity crunch. This could force you into having to sell that asset for less than you planned, particularly if interested buyers are scarce (just ask some of the banks that have collapsed in recent years as a result of exactly those sorts of liquidity squeezes).

So – planning around your goals (well) in advance can not only help you enhance the returns from your assets but also prevent costly timing mismatches.

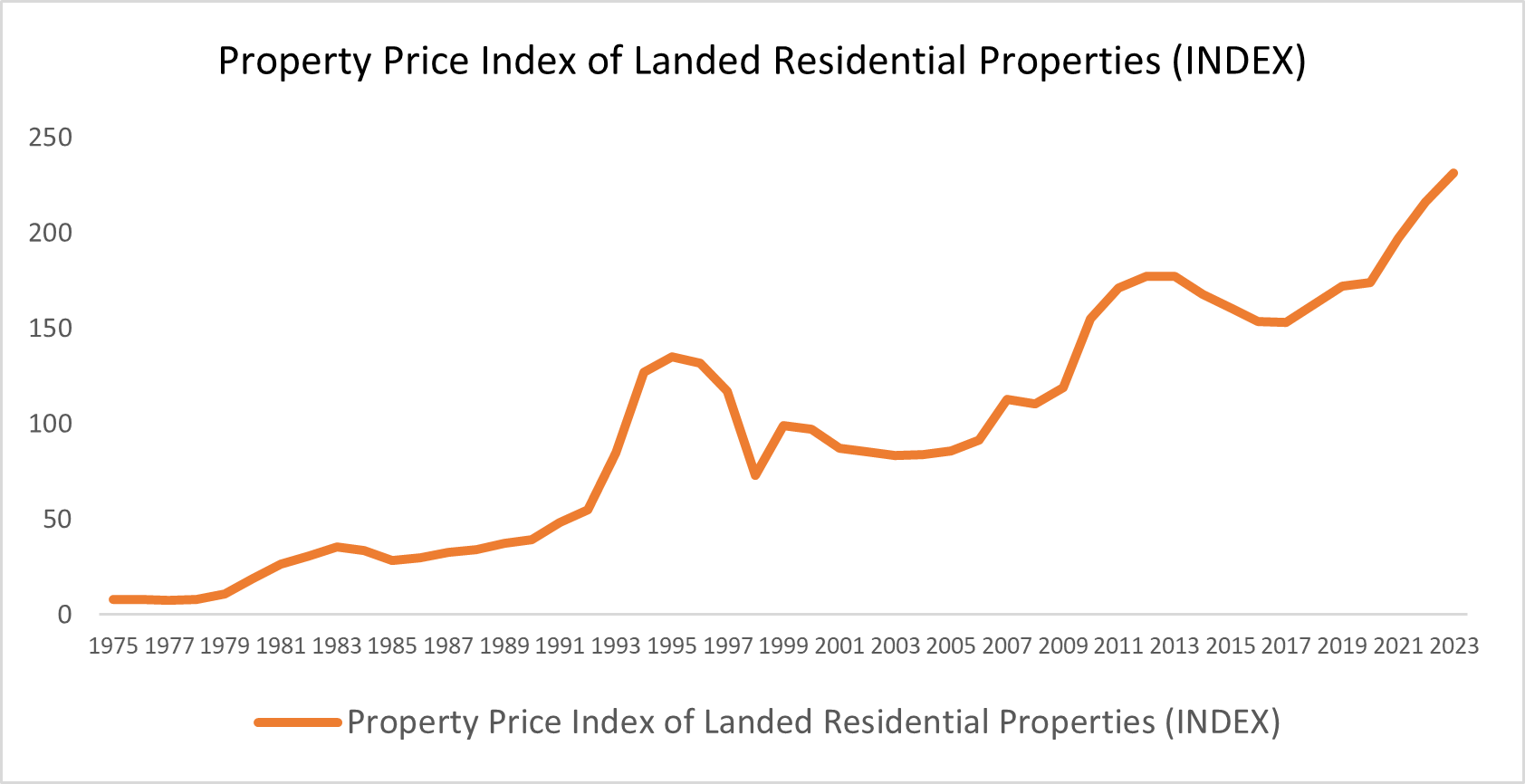

Take residential property as an example.

Since 1975, the value of Singapore’s landed residential property has risen by almost 2.5 times. However, it has not always been trending upwards, there have been periods when the market either moved sideways or down. Notably, the period between 2012 and 2017 was not a good time to sell if you needed to raise cash. Rather, it was a time to stand aside. Therefore, that meant that if you needed to raise liquidity in those 5 years, it would have been more advantageous to have a plan in place that aimed to have something else (more liquid) available for sale.

Planning for those liquidity needs would have helped you avoid being a distressed seller at exactly the wrong time. The closer you get to your goal, the more liquid you probably need to be.

Term Deposits and Government Securities

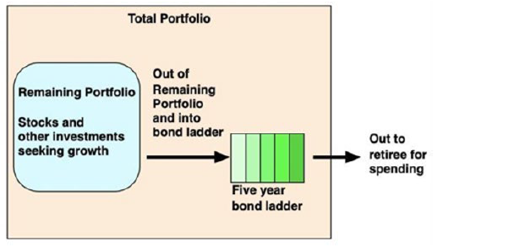

If you have a goal that needs to be funded within a fairly short period (in the 12-18 months’ timeframe), you would feel confident knowing that a combination of term deposits and a “ladder” of government securities with different maturity dates would provide the funds needed, when you need them.

However, this strategy has only turned viable in the last 18 months as interest rates have risen. You can now get a reasonable return on both cash and bonds, much better than end of 2021 – when returns on both were as good as zero.

The portfolio adjustment would look like this:

[Source: https://seekingalpha.com/article/4281609-bond-ladder-can-protect-destroy-your-portfolio]

Stocks and Bonds

But, in the long term, a mixture of stocks and bonds is still your best bet. As the saying goes, it’s all about TINA (There Is No Alternative).

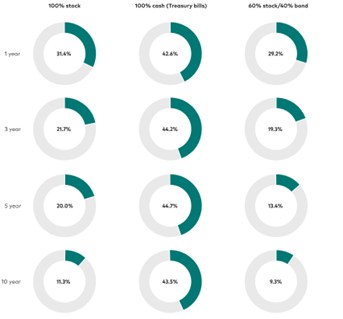

In May 2022, Vanguard published an article aiming to give context to a world facing the consequences of rapid inflation – following 4 months of spiking volatility in both stocks and bonds and a very uncertain economic outlook.

They included a study of long-term historical data (from 1930’s to the end of 2021) for three investment portfolios, 100% in stocks, 100% in T Bills and the classic 60/40 stock/bond portfolio.

Historical probability of negative return for various holding periods

[Source: Vanguard calculations as of 31 December, 2021.]

The essential message: over any time period, your chance of losing money on cash is higher than either a pure stock portfolio or the classic blend. “Losing money” happens as inflation erodes its real value and your buying power declines. The longer the time period, the greater this difference becomes.

Cash may be king when you need to meet short-term needs or goals, but for anything with a duration over a year, you will have to accept some volatility – TINA’s your auntie.