By most accounts, the first quarter of the year concluded with a better performance than expected. Even the sudden occurrence of the mini-banking crisis was kept well under control by central bankers quick to come to the rescue. Nevertheless, we at Javelin Wealth Management continue to hold a cautiously optimistic view on the market, following the market observations by Gary Dugan from The Global CIO Office:

Growth forecasts are inching up, yet the levels of core inflation are still high. Policy interest rates will likely rise and remain elevated all the way into 2024, with a risk of reversing the good first-quarter performance.

The first quarter saw global equities rake in decent gains with a 17% surge in the tech-heavy Nasdaq index. In the context of the past year, however, the global equity market index remained in a broad trading range.

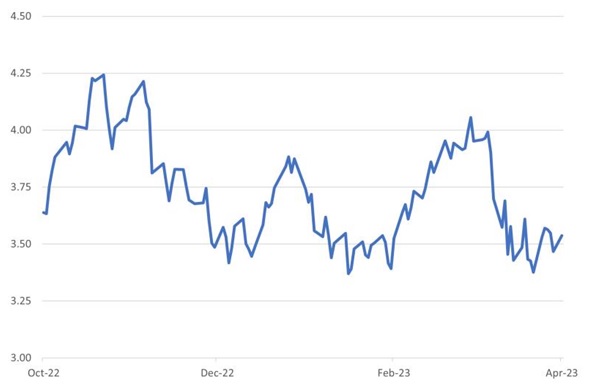

The Fed’s intervention of the banking crisis through quantitative easing contributed to the drop in the US 10-year bond yield by 40bps. Therefore, the US Fed funds rate is expected to be around 4.25-4.50% level at the December meeting, compared with the 5.5% implied in early March.

Despite the banking crisis, gold performed well, along with other industrial metals like copper and iron, reacting positively to the resurgence of Chinese demand. By contrast, oil prices were lower in the quarter due to the weaker US demand.

Read the full article here: https://lnkd.in/gcCpNBWZ

With over 20 years of wealth management experience at Javelin, we provide our clients with personalised market updates to support them on their wealth-building journey. If you’re looking to enhance your wealth, let us help you. Contact us for a personal consultation.