What a year 2022 was!

While the world was gradually opening up, ready to put the pandemic behind us, we were encountering challenges after challenges on the investment front, from the highest inflation rate in decades to the war in Ukraine. Gary Dugan from The Global CIO Office shares with us their insights here:

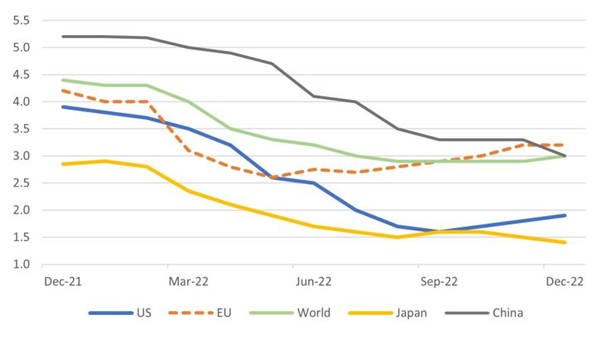

Global GDP forecasts have risen marginally, even as inflation levels remain high. While the market appears optimistic to seeing cuts in interest rates and the easing of monetary policy by the Federal Reserve towards the end of 2023, we at Javelin Wealth Management are taking a cautious stance in monitoring the Fed’s moves this year.

Global Equities and Bonds ended 2022 on a relatively positive note with better performances in the fourth quarter. Chinese government bonds were one of the best performers for the year, even with the domestic issues they were facing, which reflects their historically low correlation to the global bond markets.

Commodities wise, oil topped the table with the Brent oil price peaking at $130 per barrel in March due to the disruption from the Ukraine war. Gold, too, had a flat absolute return and a strong performance in the fourth quarter of 2022, when it was up by nearly 10%.

Dollar dominance was the key feature in 2022. The USD appreciated 12% against the Yen in 2022, but was not as strong against sterling and the euro, especially in the final quarter of the year. To read the full article, click on: https://lnkd.in/gQh3xAb7

While 2022 was a turbulent year for many investors, at Javelin Wealth Management, we keep our clients up-to-date on market conditions and provide our full support on their wealth journey, through all the ups and downs.

Contact us for a private consultation to get the dedicated support you need to achieve your wealth management goals.