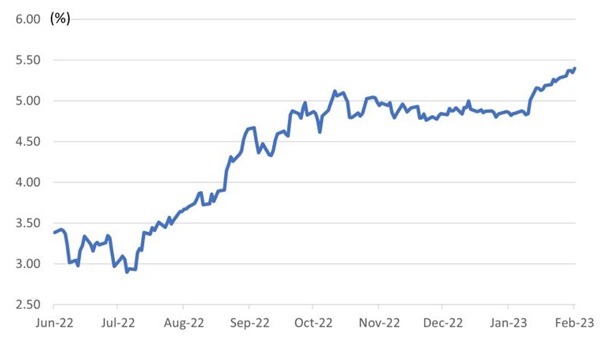

Since the start of the year, economic indicators continue to show a persistence in inflation – “stickier” components such as the personal consumption expenditures (PCE) index rose by 0.6% month-on-month, and retail sales jumped by 1.8% month-on-month. In addition, the recent strong employment report reinforces the fear that the economy is still running hot despite the increases in interest rates. Therefore, we at Javelin Wealth Management agree with Gary Dugan regarding the possibility of a 75bps increase in the rates by July this year. This may result in the following impact:

The US 10-year government bond yield breaches 4.0% (which it did on 3rd March!), with an initial target of 4.10% to 4.20%.

The US equity market will remain vulnerable to further downside, with the risk of S&P500 index falling to 3800 in the near term remain high.

On the other hand, key emerging currencies like the Indian rupee and the Indonesian rupiah should continue to hold their ground against the dollar strength as reflected to date. To read the full article please go to: https://lnkd.in/gU5EU9Zp

Another interesting observation from the recent IPO offering by the Abu Dhabi National Oil Company (ADNOC), considered the largest yet in the UAE capital, is the prevailing appetite from investors to participate in such IPOs, which bodes well for the UAE markets in 2023.

At Javelin, we delve deep into the market developments to bring our clients relevant insights to achieve their long-term wealth management goals. After all, we only recommend products that we ourselves would also invest in for the long-term. Contact us for a personal consultation today!